Automating Your Crypto Trading Journey

Cryptocurrency trading can be a complex and time-consuming endeavor, requiring constant monitoring of market trends and swift decision-making. However, with the advent of auto-trading bots, traders can now leverage the power of automation to streamline their trading strategies and seize market opportunities around the clock. Binance, a leading cryptocurrency exchange, offers a suite of advanced auto-trading bots designed to cater to various trading goals and risk appetites.

In this comprehensive guide, we’ll explore the world of Binance Auto-Trading Bots, unveiling their benefits, popular bot types, effective usage strategies, and potential risks. Whether you’re a seasoned trader looking to optimize your strategies or a newcomer seeking to navigate the crypto markets more efficiently, this article will provide valuable insights into harnessing the power of automated trading on Binance.

The Allure of Auto-Trading Bots

Auto-trading bots offer a myriad of advantages that can elevate your trading experience:

- 24/7 Trading: Unlike human traders, bots operate around the clock, ensuring that you never miss a profitable opportunity, even while you’re asleep or away from your trading station.

- Emotional Detachment: Trading decisions are often influenced by emotions like fear, greed, and overconfidence. Auto-trading bots eliminate this emotional bias, executing trades based solely on predefined parameters and market data.

- Backtesting and Optimization: Many auto-trading bots allow you to backtest your strategies on historical data, enabling you to fine-tune your parameters and optimize your trading approach before deploying it in live markets.

- Diversification and Risk Management: Certain bots can be programmed to diversify your portfolio automatically, mitigating risks by distributing your investments across multiple assets.

“Auto-trading bots are like tireless assistants, working 24/7 to execute your strategies with precision and consistency.”

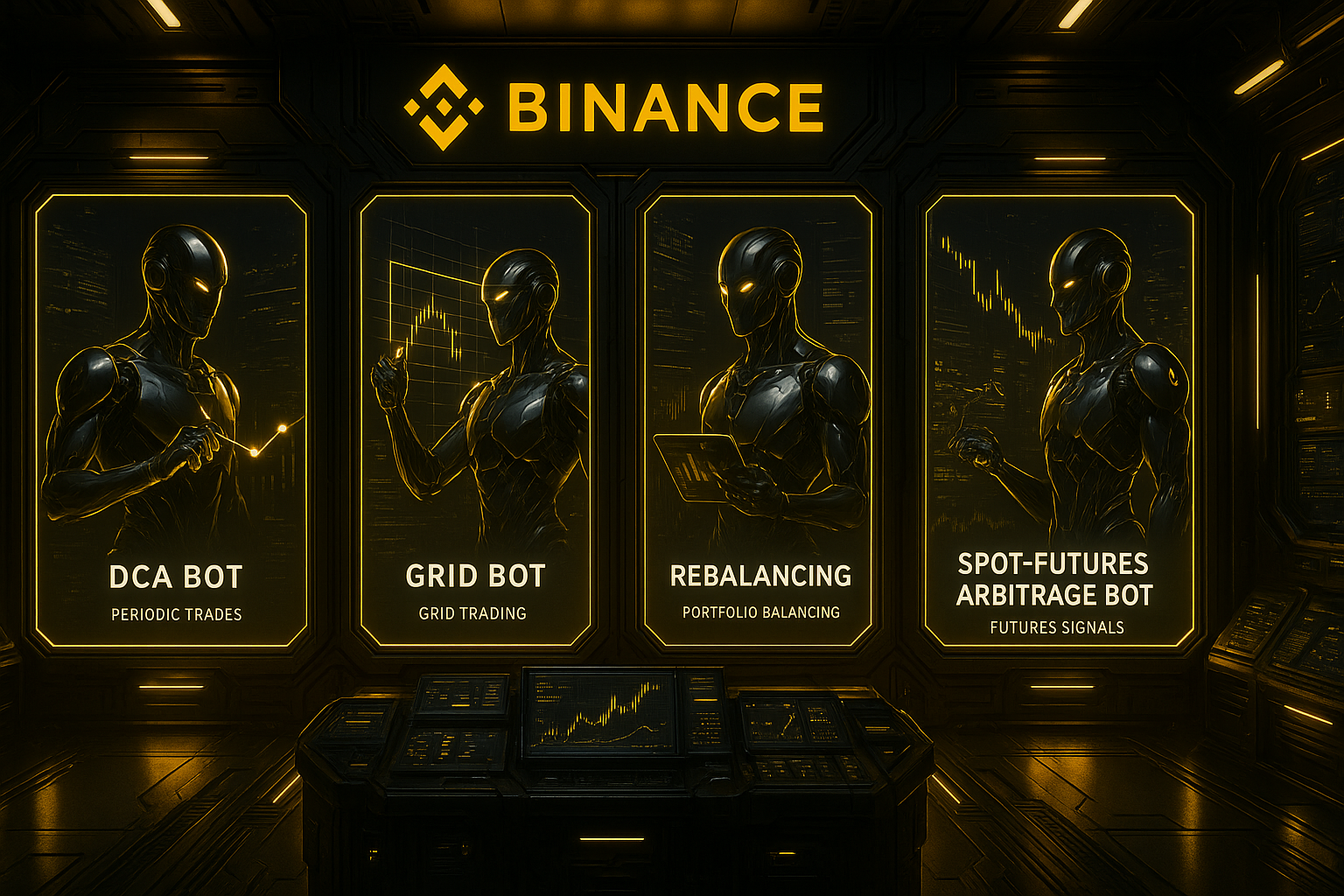

Popular Auto-Trading Bots on Binance

Binance offers a diverse range of auto-trading bots, each designed to cater to specific trading strategies and objectives. Here are some of the most popular options:

1. Spot Grid Bot

The Spot Grid Bot is a versatile tool that aims to capitalize on market volatility by placing buy orders at lower prices and sell orders at higher prices within a predefined price range. This strategy allows traders to profit from sideways market movements without needing to predict exact price levels.

Key features:

- Customizable price range and grid levels

- Automatic buy low, sell high execution

- Ideal for range-bound markets

2. Futures Grid Bot

Similar to its spot counterpart, the Futures Grid Bot employs a grid trading strategy in the futures market. By utilizing leverage, this bot offers the potential for amplified profits (and risks) by taking long or short positions based on market movements within a specified price range.

Benefits:

- Leverage trading for potentially higher returns

- Ability to profit from both upward and downward trends

- Advanced risk management options

3. Rebalancing Bot

Ideal for long-term investors, the Rebalancing Bot helps maintain a consistent asset allocation in your portfolio. It periodically adjusts the proportions of each asset, ensuring that your portfolio remains aligned with your investment goals despite market fluctuations.

To learn more, visit Tradeum

How it works:

- Set your desired asset allocation percentages

- Define rebalancing frequency (e.g., daily, weekly, monthly)

- The bot automatically buys/sells assets to maintain target allocations

4. Spot DCA and Auto-Invest

These bots implement a dollar-cost averaging (DCA) strategy, which involves regular asset purchases at predetermined intervals. The Spot DCA bot offers additional flexibility by allowing you to set selling parameters, while the Auto-Invest bot is designed for long-term, hands-off investing.

Comparison:

| Feature | Spot DCA | Auto-Invest |

| Buy orders | Yes | Yes |

| Sell orders | Yes | No |

| Customizable intervals | Yes | Yes |

| Long-term focus | Optional | Primary |

5. Order Splitting Bots (TWAP and VP)

For traders executing large orders, the TWAP (Time-Weighted Average Price) and VP (Volume Participation) bots can help minimize market impact by splitting orders into smaller increments. These bots aim to enhance liquidity, conceal large orders, and target average trading prices.

TWAP Bot:

- Splits orders based on time intervals

- Executes trades at regular intervals to achieve average price

VP Bot:

- Splits orders based on market volume

- Adjusts execution speed to match specified percentage of market volume

Harnessing the Power of Auto-Trading Bots

To maximize the potential of Binance Auto-Trading Bots, it’s crucial to adopt a strategic approach:

- Define Your Trading Goals: Clearly outline your objectives, whether it’s maximizing profits, minimizing risks, or maintaining a specific asset allocation.

- Choose the Right Bot: Select the bot that aligns with your trading strategy and risk tolerance. Consider factors such as market conditions, trading pair volatility, and your level of experience.

- Configure Parameters Carefully: Customize the bot’s parameters according to your preferences and risk appetite. Backtest your strategies on historical data to fine-tune your settings.

- Implement Risk Management: Incorporate stop-loss orders, take-profit levels, and position sizing strategies to manage your risk exposure effectively.

- Monitor and Adjust: Regularly review your bot’s performance and adapt your strategies as needed. Market conditions can change, and staying agile is essential for long-term success.

Pro Tip: Start with small investments when testing new bot strategies, and gradually increase your position size as you gain confidence in the bot’s performance.

Embracing Responsible Trading Practices

While auto-trading bots offer numerous advantages, it’s important to recognize the potential risks involved:

- Technical Glitches: Like any software, bots are susceptible to bugs, glitches, and malfunctions, which could lead to unintended trades or losses.

- Limited Adaptability: Bots operate based on predefined parameters and may struggle to adapt to extreme or unforeseen market conditions.

- Overreliance on Automation: While automation can be beneficial, it’s essential to maintain a level of human oversight and control over your trading activities.

- No Guaranteed Profits: Auto-trading bots do not guarantee success; their performance ultimately depends on market conditions, parameter settings, and the quality of the underlying code.

To mitigate these risks, it’s crucial to:

- Thoroughly evaluate the bot’s capabilities before deployment

- Implement robust risk management strategies

- Only trade with amounts you can afford to lose

- Stay informed about market trends and adjust strategies accordingly

The Road to Automated Trading Mastery

As you embark on your journey with Binance Auto-Trading Bots, keep in mind that success requires patience, discipline, and a commitment to continuous learning. Regularly review market trends, stay informed about new developments in the crypto space, and continuously refine your strategies to adapt to the ever-evolving market dynamics.

Consider the following steps to enhance your automated trading skills:

- Education: Take advantage of Binance Academy and other educational resources to deepen your understanding of trading strategies and market analysis.

- Start Small: Begin with a small portion of your portfolio to test bot strategies and gain confidence in their performance.

- Diversify: Don’t rely on a single bot or strategy. Experiment with different bots and approaches to spread risk and maximize opportunities.

- Keep a Trading Journal: Document your bot configurations, performance, and market observations to identify patterns and improve your strategies over time.

- Stay Updated: Follow Binance announcements and updates to learn about new bot features and improvements.

By combining the power of automation with your trading knowledge and disciplined approach, you can leverage Binance Auto-Trading Bots to potentially enhance your trading results and navigate the crypto markets more efficiently.

Frequently Asked Questions (FAQ)

How secure are Binance Auto-Trading Bots?

Binance employs robust security measures to protect its trading infrastructure, including encryption, multi-factor authentication, and rigorous auditing processes. However, it’s important to follow best practices, such as using secure passwords and enabling two-factor authentication on your account.

Can auto-trading bots guarantee profits?

No, auto-trading bots do not guarantee profits. Their performance depends on various factors, including market conditions, parameter settings, and the quality of the underlying code. It’s essential to approach auto-trading with realistic expectations and implement appropriate risk management strategies.

Can I use multiple auto-trading bots simultaneously?

Yes, Binance allows you to run multiple auto-trading bots concurrently, provided you have sufficient funds and meet the requirements for each bot. However, it’s crucial to carefully manage your risk exposure and ensure that your strategies do not conflict or create unnecessary overlaps.

How often should I review and adjust my auto-trading bot settings?

There is no one-size-fits-all answer, as the frequency of review and adjustment depends on various factors, such as market volatility, your trading strategy, and the bot’s performance. Generally, it’s recommended to review your bot’s performance regularly (e.g., weekly or monthly) and make adjustments as needed to optimize your strategies.

Can I use auto-trading bots on mobile devices?

While Binance offers a mobile app for trading, the auto-trading bot functionality may be limited or unavailable on mobile devices. It’s generally recommended to use a desktop or web-based interface for optimal compatibility and functionality when working with auto-trading bots.