Introducing AI-Powered Crypto Trading

Artificial intelligence has revolutionized many industries, and cryptocurrency trading is no exception. AI-powered crypto trading bots have risen in popularity due to their ability to:

- Monitor markets 24/7 without fatigue

- Execute trades at high speeds

- Analyze vast amounts of data

- Identify patterns humans may miss

- Remove emotional bias from trading decisions

For both retail and institutional crypto investors, AI bots offer the potential to:

“Outperform human traders and increase profits by leveraging advanced algorithms and machine learning capabilities.”

However, it’s important to understand how these bots operate and evaluate them carefully before use. This guide will explore the top AI crypto trading bots of 2025, how they work, and key factors to consider when choosing one.

How AI Crypto Trading Bots Operate

At their core, AI trading bots follow this general process:

- Data collection: Gather real-time and historical data from exchanges, news sources, social media, and blockchain networks.

- Analysis: Use machine learning algorithms to identify patterns and predict potential price movements.

- Strategy execution: Generate trading signals and automatically execute buy/sell orders based on predefined rules.

- Continuous learning: Refine strategies over time by analyzing outcomes and adapting to changing market conditions.

Some common trading strategies employed by AI bots include:

- Arbitrage: Exploit price differences across exchanges

- Trend following: Use technical indicators like moving averages to ride market trends

- Mean reversion: Buy/sell when prices deviate significantly from historical averages

- Market making: Provide liquidity through simultaneous buy/sell orders

The most advanced bots can even combine multiple strategies and switch between them based on market conditions.

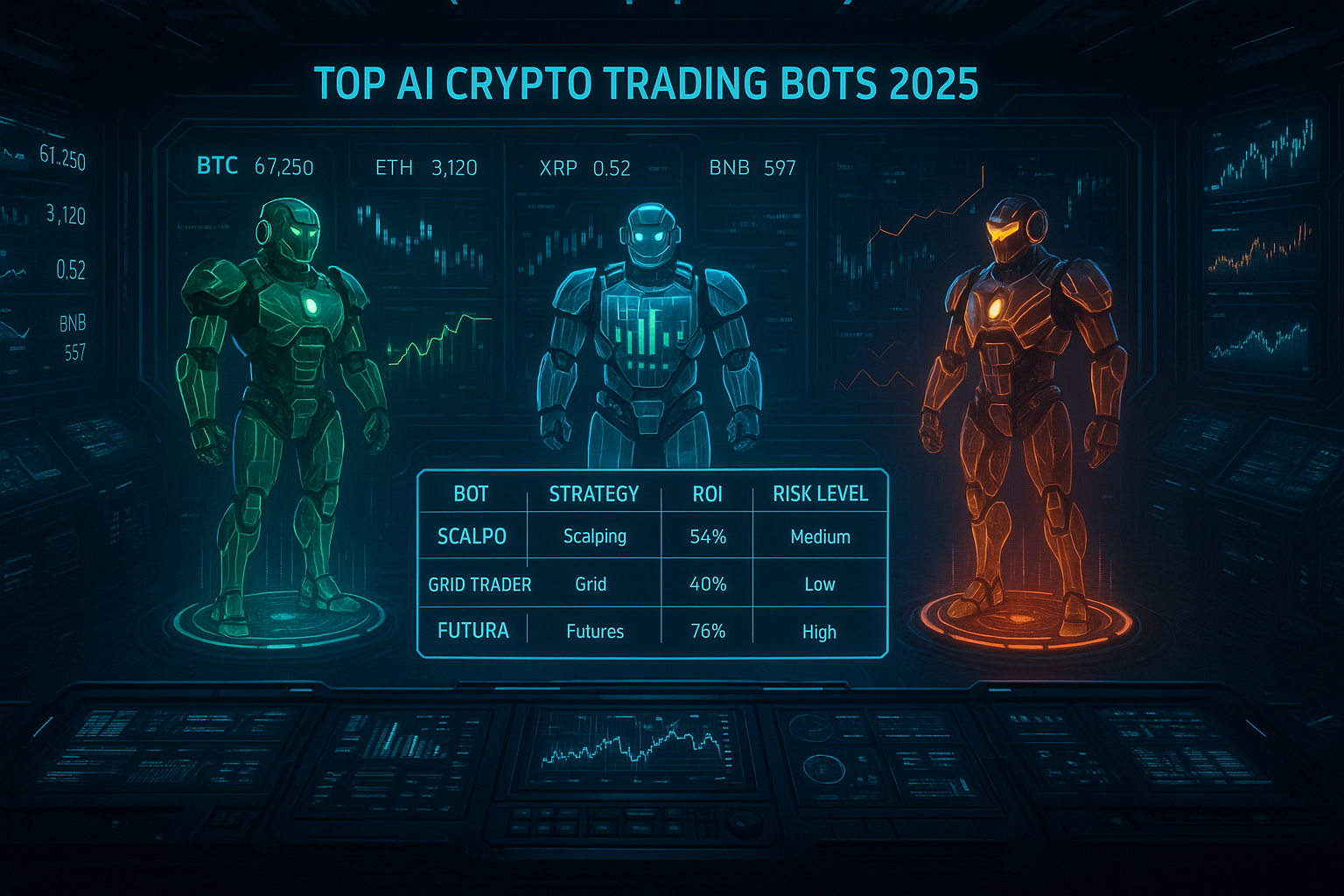

Top AI Crypto Trading Bots of 2025

1. 3Commas

Key Features

- Multiple bot types (DCA, Grid, Options, etc.)

- Smart Trading terminal for manual orders

- Portfolio-management tools

- Back-testing and paper trading

Pricing

- Free plan available

- Paid plans from $29 to $99 per month

Pros

- User-friendly interface

- Supports 16 + major exchanges

- Highly customizable trading strategies

Cons

- Past security breaches raise some concerns

2. CryptoHopper

Key Features

- Strategy marketplace

- Drag-and-drop strategy designer

- Social-trading capabilities

- AI-powered strategy switching

Pricing

- Free plan available

- Paid plans from $19 to $99 per month

Pros

- No coding required

- 130 + built-in technical indicators

- Cloud-based 24 / 7 operation

Cons

- Advanced features locked behind higher tiers

To learn more, visit Tradeum

3. Shrimpy

Key Features

- Automated portfolio rebalancing

- Social trading and portfolio copying

- Universal API for multiple exchanges

- Detailed analytics and performance tracking

Pricing

- Free basic plan

- Paid plans from $15 to $39 per month

Pros

- Ideal for long-term investors

- Simple for beginners

- Supports 30 + exchanges

Cons

- Limited bot-customization options

4. Coinrule

Key Features

- Rule-based trading strategies

- 150 + pre-built templates

- No-code strategy builder

- Demo mode for testing

Pricing

- Free starter plan

- Paid plans from $29.99 to $449.99 per month

Pros

- Very beginner-friendly

- Extensive educational resources

- Intuitive drag-and-drop interface

Cons

- Fewer supported exchanges than some competitors

5. Pionex

Key Features

- 16 free built-in trading bots

- Grid and DCA bots

- Futures-trading bots

- AI-assisted strategy creation

Pricing

- No subscription fees

- 0.05 % trading fee per transaction

Pros

- Free built-in bots

- Low trading fees

- Easy for beginners

Cons

- Limited customization

- No back-testing

6. Tradeum.ai

Key Features

- Fully automated AI spot-trading on Binance (road-map for more exchanges)

- Smart risk management with dynamic position sizing and automatic pause in extreme volatility

- Real-time transparent performance dashboard

- “Plug-and-play” setup—no strategy coding required

Pricing

- Paid subscription only (3-, 6-, and 12-month tiers)

- Approx. $60 per month, with discounts for longer terms

Pros

- Spot-only approach avoids leverage risk

- Clear, real-time reporting builds trust

- No hidden commissions—subscription covers all features

Cons

- Currently supports only Binance

- Strategy is not user-configurable

- No free plan or paper-trading mode yet

Other Notable Bots

- TradeSanta – Known for its user-friendly interface and diverse bot types.

- Bitsgap – Offers a wide range of customizable bots and strategies.

- Kryll – Features a marketplace of user-created trading strategies.

Factors to Evaluate AI Crypto Bots

When choosing an AI trading bot, consider the following:

- Trading goals: Ensure the bot aligns with your investment objectives and risk tolerance.

- Supported exchanges: Verify compatibility with your preferred trading platforms.

- Available strategies: Look for bots offering strategies that match your trading style.

- Customization: Evaluate the level of strategy customization allowed.

- Ease of use: Consider your technical expertise and choose a bot with an appropriate learning curve.

- Pricing model: Compare subscription costs, trading fees, and potential hidden charges.

- Security measures: Look for bots with strong encryption, API security, and a clean track record.

- Performance history: Review available data on the bot’s past trading performance.

- Community and support: Check for active user communities and responsive customer support.

Managing Risks with AI Trading

While AI bots can enhance trading, they are not without risks:

- Technical failures: Bots can malfunction due to bugs, network issues, or exchange API problems.

- Over-optimization: Bots may be over-fitted to past data, leading to poor real-world performance.

- Market anomalies: Unusual events can cause bots to make poor decisions.

- Security vulnerabilities: Poorly secured bots could be hacked, risking your funds and data.

To mitigate these risks:

- Start with small trading amounts to test bot performance.

- Regularly monitor bot activity and overall portfolio health.

- Use stop-loss orders and position sizing to limit potential losses.

- Keep API keys secure and use reputable, well-maintained bot platforms.

- Stay informed about market conditions and be ready to intervene manually if needed.

Beyond Bots: Emerging AI Applications in Crypto

AI’s impact on crypto extends beyond trading bots:

- Price predictions: Advanced models attempt to forecast short and long-term price movements.

- Sentiment analysis: AI tools gauge market sentiment from news and social media.

- Risk assessment: Machine learning helps evaluate project and investment risks.

- Fraud detection: AI systems identify suspicious transactions and potential scams.

- Portfolio optimization: Algorithms suggest ideal asset allocations based on goals and risk tolerance.

As natural language AI like GPT advances, we may see:

- More sophisticated market analysis from AI “experts”

- AI-powered research assistants for crypto investors

- Automated report generation and investment theses

These developments could further democratize access to high-level crypto investing strategies.

A Trader’s Best Friend or Foe?

AI trading bots represent a powerful tool in the crypto investor’s arsenal, but they are not a magic solution. When used responsibly, they can:

- Enhance trading efficiency

- Reduce emotional decision-making

- Uncover opportunities human traders might miss

- Execute complex strategies with precision

However, successful AI trading still requires:

- A solid understanding of crypto markets

- Careful bot selection and configuration

- Ongoing monitoring and risk management

- The flexibility to adapt strategies as needed

Ultimately, AI bots are best viewed as a complement to human expertise rather than a replacement. The most successful traders will likely be those who can effectively combine AI capabilities with their own market insights and decision-making skills.

Frequently Asked Questions (FAQ)

Q: What are the benefits of using AI crypto trading bots?

A: AI bots offer 24/7 market monitoring, faster trade execution, removal of emotional bias, and the ability to analyze large amounts of data quickly.

Q: How much do AI trading bots typically cost?

A: Costs vary widely, from free basic plans to premium subscriptions costing $100+ per month. Some bots charge per trade instead of or in addition to subscriptions.

Q: Are AI bots guaranteed to be profitable?

A: No, there are no guarantees in trading. While AI bots can enhance performance, they still carry risks and can lose money in unfavorable market conditions.

Q: What trading strategies do AI crypto bots employ?

A: Common strategies include arbitrage, trend following, mean reversion, and market making. Advanced bots may combine multiple strategies.

Q: How can traders ensure the security of their funds when using bots?

A: Use reputable platforms, enable two-factor authentication, use API keys with trading-only permissions, and regularly monitor bot activity.

Q: How much human oversight is required when using AI trading bots?

A: While bots can operate autonomously, regular monitoring is crucial. Traders should review performance, adjust strategies as needed, and be prepared to intervene during unusual market events.